/

The best trades require research, then commitment.

$0 forever, no credit card needed

Alex Honnold, free climber

Photo: Jimmy Chin ©

Where the world does markets

Join 100 million traders and investors taking the future into their own hands.

Love in every #TradingView

100M+

Traders and investors use our platform.

#1

Top website in the world when it comes to all things investing.

1.5M+

Mobile reviews with 4.9 average rating. No other fintech apps are more loved.

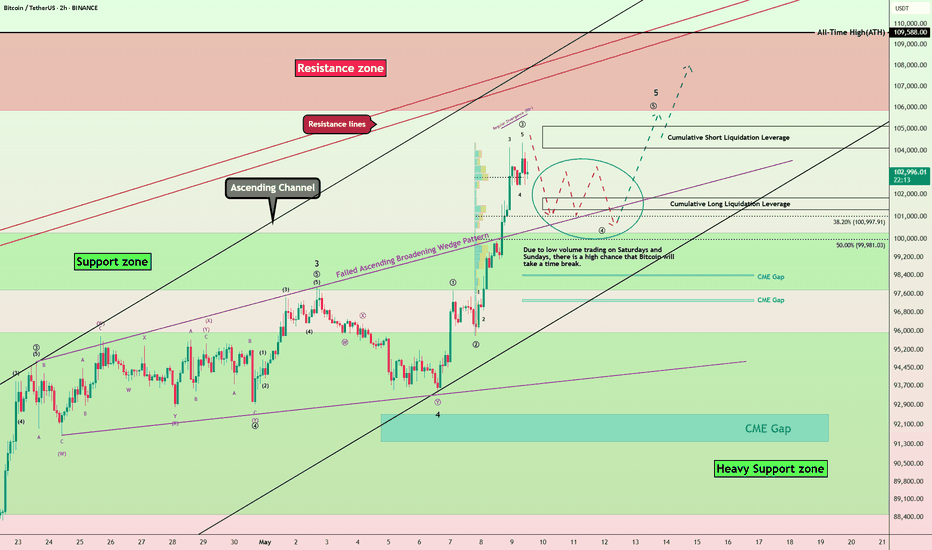

BITCOIN Breaks Higher - Is $106K the Next Target?COINBASE:BTCUSD is trading within an ascending channel, signaling bullish momentum. The price has consistently respected the channel boundaries, forming higher highs and higher lows, which aligns with the continuation of the uptrend.

Recently, the price has broken out with strong momentum and may

Intraday Playbook ES Futures: Trade Setup & Context CME_MINI:ES1!

Big Picture Context

Please see related trade idea.

In this analysis, we refine our intraday levels to identify potential trade setups. We also review recent price action and present a high-probability long trade example that frequently offers favorable risk-reward dynamics when

Disney Stock Pops on Strong Earnings Data. Turnaround Working?The Magic Kingdom just pulled a rabbit out of its hat — and Wall Street’s loving it.

Disney stock NYSE:DIS surged 11% on Wednesday, not just for its best day in a year, but for the kind of earnings beat that makes analysts reconsider their entire valuation model while retail traders tweet “ NYSE:

EURUSD Bearish Structure Forming Amid Dollar UncertaintyEURUSD appears to be carving out a series of lower highs, showing potential signs of distribution. With price compressing inside a symmetrical triangle following multiple failed breakout attempts, the stage could be set for a bearish breakdown. This comes as U.S. inflation and Fed policy hold the sp

BTC - Golden Pocket test & what comes next?Bitcoin (BTC) has been steadily recovering from its January correction, entering a promising uptrend that has now brought it to a crucial technical juncture: the Golden Pocket Fibonacci zone, which lies between the 61.8% and 65% retracement levels. This area is widely watched by traders, as it often

Market Insights with Gary Thomson: 5 - 9 MayMarket Insights with Gary Thomson: Fed and BoE Rate Decisions, Canada Jobs, Earnings Reports

In this video, we’ll explore the key economic events, market trends, and corporate news shaping the financial landscape. Get ready for expert insights into forex, commodities, and stocks to help you naviga

Arbitrum (ARB): Multiple Good Risk:Reward Ratio Trades | SidewayArbitrum caught our attention with a possible BOS forming on smaller timeframes and a good sideways channel forming, which eventually we are looking to be broken, where we might be taking a sweet long position with some good R:R.

More in-depth info is in the video—enjoy!

Swallow Academy

Break and retest setup on NFLX soon? OptionsMastery:

🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can c

US Stocks Pare Back All Tariff-Fueled Losses. Are We So Back?Remember “Liberation Day”? The one that felt more like Liquidation Day ? When markets tanked, tickers turned red, and you were afraid to check the markets on the next day? Well, turns out the rumors of the market’s demise were — once again — greatly exaggerated.

If the average recession 10 years a

BTC Building Strength – Breakout Ahead?$BTC/USDT Weekly Analysis

Bitcoin continues to respect the 50 EMA on the weekly timeframe — a key dynamic support level that has consistently held throughout this bullish structure.

Each time BTC corrected, it found support near the 50 EMA before bouncing back with strength. The current structure

See all editors' picks ideas

pymath█ OVERVIEW

This library ➕ enhances Pine Script's built-in types (`float`, `int`, `array`, `array`) with mathematical methods, mirroring 🪞 many functions from Python's `math` module. Import this library to overload or add to built-in capabilities, enabling calls like `myFloat.sin()` or `myIntArra

Best SMA FinderThis script, Best SMA Finder, is a tool designed to identify the most robust simple moving average (SMA) length for a given chart, based on historical backtest performance. It evaluates hundreds of SMA values (from 10 to 1000) and selects the one that provides the best balance between profitability,

Bitcoin Monthly Seasonality [Alpha Extract]The Bitcoin Monthly Seasonality indicator analyzes historical Bitcoin price performance across different months of the year, enabling traders to identify seasonal patterns and potential trading opportunities. This tool helps traders:

Visualize which months historically perform best and worst for

Market Manipulation Index (MMI)The Composite Manipulation Index (CMI) is a structural integrity tool that quantifies how chaotic or orderly current market conditions are, with the aim of detecting potentially manipulated or unstable environments. It blends two distinct mathematical models that assess price behavior in terms of bo

Dual-Phase Trend Regime Oscillator (Zeiierman)█ Overview

Trend Regime: Dual-Phase Oscillator (Zeiierman) is a volatility-sensitive trend classification tool that dynamically switches between two oscillators, one optimized for low volatility, the other for high volatility.

By analyzing standard deviation-based volatility states and applying

Nasan Risk Score & Postion Size Estimator** THE RISK SCORE AND POSITION SIZE WILL ONLY BE CALCUTAED ON DIALY TIMEFRAME NOT IN OTHER TIMEFRAMES.

The typically accepted generic rule for risk management is not to risk more than 1% - 2 % of the capital in any given trade. It has its own basis however it does not take into account the stocks

NIG Probability TableNormal-Inverse Gaussian Probability Table

This indicator implements the Normal-Inverse Gaussian (NIG) distribution to estimate the likelihood of future price based on recent market behavior.

📊 Key Features:

- Estimates the parameters (α: tail heaviness, β: skewness, δ: scale, μ: location)

of th

Log-Normal Price ForecastLog-Normal Price Forecast

This Pine Script creates a log-normal forecast model of future price movements on a TradingView chart, based on historical log returns. It plots expected price trajectories and bands representing different levels of statistical deviation.

Parameters

Model Length –

Market Sessions & Viewer Panel [By MUQWISHI]▋ INTRODUCTION :

The “Market Sessions & Viewer Panel” is a clean and intuitive visual indicator tool that highlights up to four trading sessions directly on the chart. Each session is fully customizable with its name, session time, and color. It also generates a panel that provides a quick-glance

Elastic Volume-Weighted Student-T TensionOverview

The Elastic Volume-Weighted Student-T Tension Bands indicator dynamically adapts to market conditions using an advanced statistical model based on the Student-T distribution. Unlike traditional Bollinger Bands or Keltner Channels, this indicator leverages elastic volume-weighted averaging

See all indicators and strategies

Community trends

WC: 27.54 Target: 1800-2400 MOASS: 47k-100K: #GME20WeekCycleLast weeks post, Gamestop Decoded, laid bare everything that I'm fully confident on related to the timing of settlement cycles and The Cats plays

To summarize, GME moves on a 20 week settlement cycle that in its current iteration kicked off the week of Nov 27, 2023

The Cat seems to be amplifying p

$U $20 support, flagging in ascension Interesting setup here. Looks pretty good IMO. Software is a great name to look at in this market environment. It has a nice support at $20, even at large volume here it’s holding nicely so it shows relative strength. This name is definitely bullish long term. I’m in $21.5c for 2 weeks out, this is

TESLA: Short Trade with Entry/SL/TP

TESLA

- Classic bearish formation

- Our team expects fall

SUGGESTED TRADE:

Swing Trade

Sell TESLA

Entry Level - 298.27

Sl - 310.31

Tp - 265.48

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a mont

Chapter 1: "The Quantum Reckoning of RGTI"Inside the 7D lattice of entangled time...where markets no longer tick but pulse with the heartbeat of quantum threads...stood the great digital monument:

RGTI ,

the quantum gatekeeper.

This wasn’t just a ticker. It was a fullstack, enterprise-tier quantum computing engine used by global milita

TESLA Resistance Ahead! Sell!

Hello,Traders!

TESLA stock is growing

And we are bullish biased

Mid-term but the price is

About to hit a horizontal

Resistance of 322.00$

So after the retest we

Will be expecting a local

Bearish correction

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

GME Potential BreakoutBreakout or Fakeout ? You decide...

We are not registered or licensed in any jurisdiction whatsoever to provide investing advice or anything of an advisory or consultancy nature.

and are therefore are unqualified to give investment recommendations.

Always do your own research and consult with a lic

LYFT stock is a grower and undervalued, future 10x ?LYFT stock is trading a low pe and has a potential smooth 25% annual growth rate to EPS for next years.

PE price /earnings is low at around 11.

More cash than debt on the balance sheet, making them a little cheaper.

easily should be worth 20-25 PE for a fair price. Growth rate should make LYFT

Coin to bounceAs BTC pivots here I have entered another CONL trade. I have avoided the ticker since my big exit around 250$ a while ago. This strong bounce and the retake of the golden fib, with a retest is bullish. Momentum is starting to fire up, and volatility is not in a reset zone. With Bitcoin looking so bu

See all stocks ideas

Today

RDNTRadNet, Inc.

Actual

−0.50

USD

Estimate

−0.13

USD

Tomorrow

DOLEDole plc

Actual

—

Estimate

0.39

USD

Tomorrow

CNTYCentury Casinos, Inc.

Actual

—

Estimate

−0.50

USD

Tomorrow

RMTIRockwell Medical, Inc.

Actual

—

Estimate

−0.05

USD

Tomorrow

PRKSUnited Parks & Resorts Inc.

Actual

—

Estimate

−0.23

USD

Tomorrow

ALLTAllot Ltd.

Actual

—

Estimate

−0.05

USD

Tomorrow

SBHSally Beauty Holdings, Inc. (Name to be changed from Sally Holdings, Inc.)

Actual

—

Estimate

0.39

USD

Tomorrow

NMRANeumora Therapeutics, Inc.

Actual

—

Estimate

−0.37

USD

See more events

Community trends

Bitcoin Breaks Wedge! Correction Coming Before Next Leg? After Trump said in the press conference, " Better go out and buy stocks now ." The SPX500 index started pumping , and as I said in the ideas of the last few days, Bitcoin ( BINANCE:BTCUSDT )'s correlation with this index has increased. Bitcoin also started pumping.

Yesterday's Bitcoin pum

BTC - Accumulation, Manipulation & Distributioncurrent market structure

this btcusdt 1-hour chart illustrates a classic three-phase market structure: accumulation, manipulation, and potential distribution. the price action follows a strong bullish impulse, after which the market enters a sideways range suggesting absorption of previous selling

BITCOIN → Consolidation before the rally. 106K - 110K?BINANCE:BTCUSDT , after breaking out of consolidation at 97,860 and distributing to 104,300, has returned to a consolidation phase, which is generally a positive sign for possible continued growth.

The growth of Bitcoin is linked to several reasons:

General improvement in the global market s

BITCOIN Breaks Higher - Is $106K the Next Target?COINBASE:BTCUSD is trading within an ascending channel, signaling bullish momentum. The price has consistently respected the channel boundaries, forming higher highs and higher lows, which aligns with the continuation of the uptrend.

Recently, the price has broken out with strong momentum and may

BTC at Critical DP: Rising Wedge Breakdown or Bounce?!Hello guys!

1. Bearish Breakdown (Primary Setup):

If price breaks below the rising wedge support and sweeps the recent low, it confirms the breakdown.

This would be a strong signal to enter short positions, with a downside target around the 99,000–98,500 zone.

Breakdown confirmation: Close below bo

BITCOIN - Price can correct to support line of rising channelHi guys, this is my overview for BTCUSDT, feel free to check it and write your feedback in comments👊

Some days ago, the price entered a triangle, where it dropped to the support line, after which it rose briefly to the resistance line.

Then, price exited from the triangle pattern and made a retest

SUI Elliott Wave Meets Fibonacci: Wave 5 Setup ExplainedSUI has once again delivered a textbook display of wave structure, Fibonacci precision, and anchored VWAP interaction. After finishing Wave 4, price surged upward, tagging key fib levels and now consolidating at a critical decision point. The next high-probability trade opportunity is forming — and

Bitcoin is consolidating and may continue to riseBitcoin is in consolidation and feels good. We have a bullish trend sitting, strong support, zone of interest and liquidity and strong resistance. Most importantly, we have consolidation

Price may test 103000 before continuing upwards

There may be a small correction to 103K before breaking 104200,

See all crypto ideas

Gold - New All Time High in the making?market context and trend environment

This 4-hour chart of Gold (XAU/USD) from OANDA illustrates a strong impulsive structure within a broader bullish trend. Following a sharp upward movement that broke through previous structure, gold formed a swing high before entering a corrective phase. The mark

GOLD 1H CHART ROUTE MAP & TRADING PLAN FOR THE WEEKHey Everyone,

Please see our updated 1h chart levels and targets for the coming week.

We are seeing price play between two weighted levels with a gap above at 3341 and a gap below at 3307. We will need to see ema5 cross and lock on either weighted level to determine the next range.

We will see l

Gold: Potential Bullish Reversal Setup on XAU/USD from QML ZoneHello guys!

What I see:

QML in Lower Time Frame:

Price is currently testing a QML zone from a lower timeframe (marked in light blue).

This area aligns with a significant reaction point, suggesting institutional interest.

QML in Higher Time Frame:

Below this lies a higher timeframe QML,

Gold will continue to grow and exit from pennantHello traders, I want share with you my opinion about Gold. After looking at this chart, we can see how the price of Gold has been developing inside an upward pennant, formed after a powerful impulse from the buyer zone. This earlier move created a strong bullish foundation, supported by consistent

2025 is 1969? Downtrend to 26,000Just some observations but I can see NUMEROUS similarities between the two charts

There are 8 instances that are EXACTLY the same between the two. This is more than random chance.

1. Range

2. Yearly Open at top of the range before the spike down

3. 1962 and Covid Dump

4. Bullish

Tariff War Easing Signals: Gold Trend Analysis for Next WeekSince the issue of tariffs broke out, the development of the situation has not been in line with the expectations of the US government. In the face of the escalating trade frictions, the senior officials of the United States have released signals of easing through multiple channels and repeatedly ex

Lingrid | GOLD Weekly MARKET Analysis: CONSOLIDATION PhaseOANDA:XAUUSD has made a positive move but faced resistance at $3,430, with strong support established at $3,250. The market is likely to trade sideways or experience a deeper correction in the near term. A major resistance barrier appears to be forming overhead, making further upside difficult with

(XAU/USD) Bearish Trade Setup – Targeting $3,222 with 1:6 Risk/REntry Point: Around 3,409.33 - 3,408.41 USD.

Stop Loss: 3,437.87 USD.

Target (Take Profit): 3,222.53 USD.

Risk/Reward Ratio: Approximately 1:6, which is favorable.

📉 Price Action & Trend Analysis:

A rising wedge (or channel) appears to have formed and broken to the downside — a bearish signal.

GOLD → Return to range. Fall from resistance...FX:XAUUSD is reacting to data related to the tariff war. The price is returning to the range and forming a false breakout of resistance. The level of 3370 and the zone of interest at 3387 play a key role.

On Thursday, gold rose to $3,400 amid a weaker dollar, increased demand for safe-haven as

GOLD : This time is different Hello !

No, this time is now different. It was a joke.

*****************************************************

1- Bar pattern of the last bull run is a true way of gold for us. This is almost perfection.

***

2- The objective is 7000-8000$ per once. The top momentum can really hit 10k or 12k if the d

See all futures ideas

EURUSD – Bearish Rejection and Targeting the 4H Imbalance ZoneEURUSD has shifted into a clear bearish tone following multiple rejections from a well-established resistance level. Over the past several weeks, price has struggled to break above that zone, showing consistent signs of selling pressure each time it attempted a push higher. The most notable move cam

HelenP. I Euro may break resistance level and rise to trend lineHi folks today I'm prepared for you Euro analytics. If we look at the chart, we can see how the price a long period of slow decline, finally showing early signs of potential reversal. The price has been moving inside a falling wedge pattern, consistently testing lower highs and lower lows. But now,

AUDJPY Breakout on Rising Yields – Path Open to 95.70AUDJPY is maintaining strong bullish structure after breaking through key resistance around 91.65. Price is forming higher lows supported by an ascending trendline, indicating healthy buyer momentum. Fibonacci retracement levels show price holding above the 50% and 61.8% zones, strengthening the bul

AUD/USD) Technical Analysis Read The ChaptianSMC-Trading Point update

Technical analysis of the AUD/USD currency pair on the 1-hour timeframe. Here's the idea behind the analysis:

Key Elements:

1. Support and Resistance Levels:

Resistance zone: Around 0.64350–0.64450

Support zone: Around 0.63450–0.63550

2. EMA (200):

The price is c

#EURUSD: At Perfect Area to Swing Sell Worth 1300+ Pips! The FX:EURUSD price is currently showing strong sell momentum, indicating a potential strong bearish trend in the coming time. We’ve already taken two swing sell positions on EURUSD. There are three targets you can set according to your own plan and strategy.

The DXY index suggests further price gr

1. EUR/USD Buy Setup1. Entry Point:

Marked at: 1.12243

This is the suggested price level to enter a long (buy) trade.

2. Stop Loss:

Set at: 1.11542

Placed below a support zone, it limits the downside risk if the trade moves against the position.

3. Target Points:

EA Target Point One: 1.13891

EA Target Point (

USDCHF Analysis: Break & Retest or Mean Reversion?Hello traders!

USDCHF is offering two trading scenarios on the daily timeframe.

The first scenario suggests the pair may react bearishly from the resistance zone, setting up a break-and-retest opportunity that could drive price lower toward the 0.80001 area.

The second scenario anticipates a boun

EUR/USD bearish outlookEUR/USD Weekly Outlook – Bearish Scenario in Play

This week’s outlook for EUR/USD is leaning towards a bearish continuation.

Price recently respected the 3H demand zone and gave a clean bullish reaction following the expected Asia low sweep. I didn’t manage to catch an entry as it happened quite la

EURUSDEUR/USD Interest Rate Differential and Economic Data for May 2025: Directional Bias

Interest Rate Differential

European Central Bank (ECB):

Cut rates by 25 basis points in March 2025, lowering the deposit facility rate to 2.50%.

Dovish outlook: Inflation is projected to average 2.3% in 2025, with fu

GBPJPY BULLISH OR BEARISH DETAILED ANALYSISGBPJPY is currently trading near 190.80 and is forming a significant breakout structure on the 3-day chart. After months of consolidation under a descending trendline, the pair is now coiling tightly, signaling a potential bullish breakout. The pair has respected the lower support range near 183.70

See all forex ideas

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - |

Trade directly on the supercharts through our supported, fully-verified and user-reviewed brokers.